Renters Insurance in and around Houston

Renters of Houston, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through coverage options and deductibles on top of work, keeping up with friends and family events, can be time consuming. But your belongings in your rented townhome may need the incredible coverage that State Farm provides. So when mishaps occur, your home gadgets, souvenirs and sports equipment have protection.

Renters of Houston, State Farm can cover you

Renters insurance can help protect your belongings

State Farm Has Options For Your Renters Insurance Needs

You may be doubtful that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. The cost of replacing your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

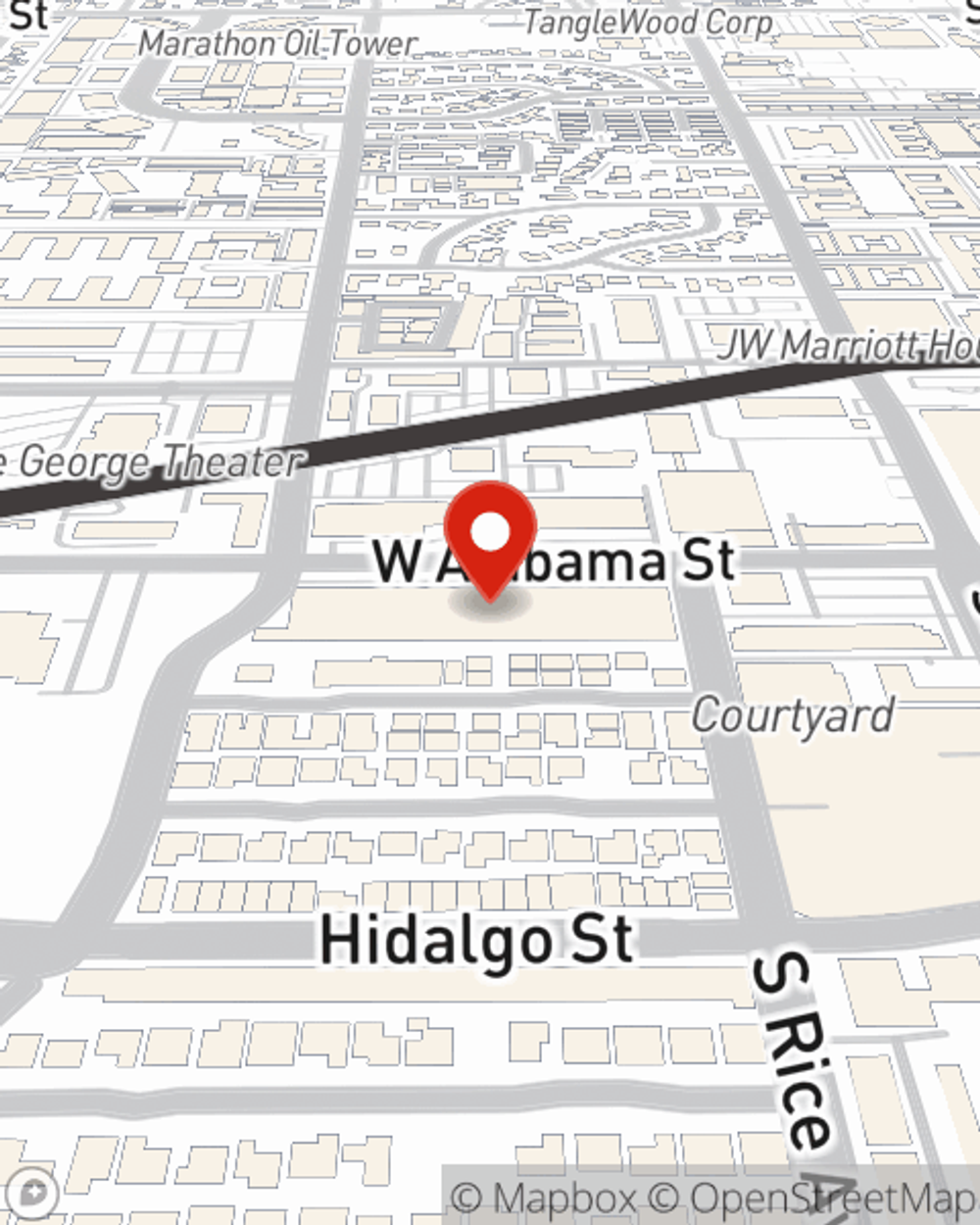

State Farm is a reliable provider of renters insurance in your neighborhood, Houston. Call or email agent Felicia Olowu today and see how you can save!

Have More Questions About Renters Insurance?

Call Felicia at (281) 745-9067 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Felicia Olowu

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.